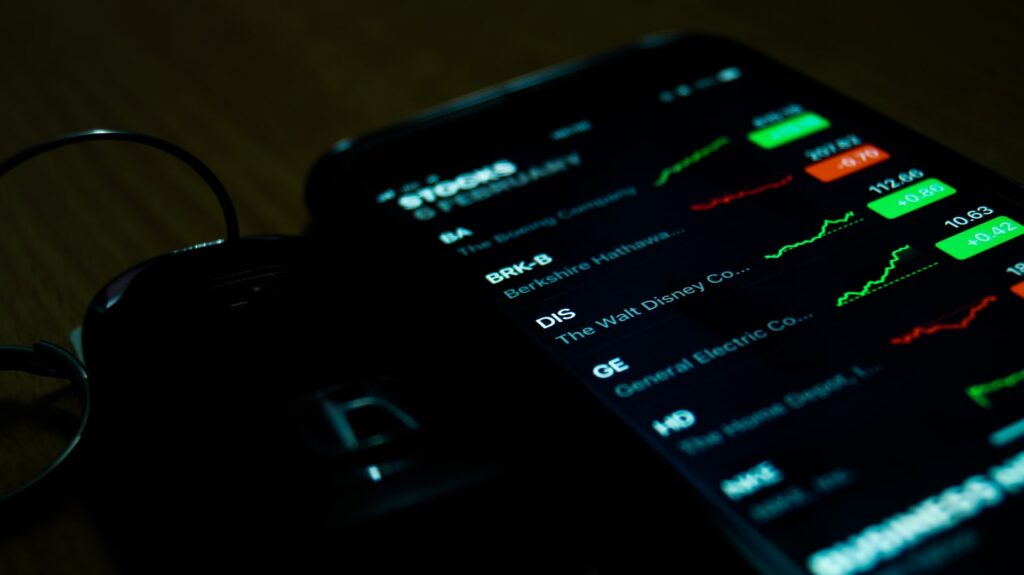

Investing in company stocks successfully is not luck—it’s a combination of following simple rules and making wise decisions. Success in investing can be as little or as much as you want.

No strategy in this world will guarantee you only pick winning stock, and if there is, it’s yet to be discovered. You have to understand that even the best practices can lead to losses.

When you invest in stocks, you need to have a large measure of accepting reality and knowing that markets and stocks will fall and rise occasionally.

The best you can do to ensure you’re investing in stocks correctly is to follow some of the guidelines set out by great investors. These rules will improve your chances of picking winning stocks and help you avoid losses.

Here are some golden rules of investing you could follow to make your investing journey a success.

https://unsplash.com/photos/UXEJDX4SqdE

Don’t Let Fear Rule Your Investing Choices

When the market is going down or showing signs of going down, many investors opt-out and sells their stock, usually, that’s when there are a lot of bargains. The stock market is the only market where items go on sale when people are too scared to buy.

This is the ideal time when you should consider investing because what goes down must come up, and you could make a killing depending on your initial investment amount. Also read : 5 Easy Steps to Create A Marketing Dashboard

Discipline Matters When You’re Investing

As an investor, you have to continuously save regardless of whether the climate is good or bad if you can only put away a tiny amount. By investing regularly, you’ll develop the habit of living below your means as you build up a portfolio of assets over time.

An excellent investment route is going with commission-free stock trading. Commission-free trading means your stock won’t have any charge.

https://unsplash.com/photos/VP4WmibxvcY

Invest in Businesses You Understand

You could buy stock from literally thousands of companies, some of which are well-known, and sell everyday services and products. These are the companies you should look into and consider investing in.

There’s usually a close connection between a product or services’ success and the performance of its company stock.

When a product is common, it means consumers understand and accept it. For instance, understanding them usually means you could have a picture of how the company works from any of the products you use.

Another category of companies to invest in are the ones you have an above-average understanding of. It could be because you’re employed in the industry or have been in the past. Or, it could be that you have a particular interest in a specific industry, even though you don’t use their services or products.

As a rule of thumb in investing, stay away from companies you don’t understand, even if that company is showing a lot of promise.

They could only be selling a stake with no substantial numbers. If you find it difficult to grasp what they’re doing and how they’re making money, then you should avoid investing in those stocks.

Don’t Time the Market.

A lot of investment experts advise against trying to time the market. This could be trying to sell or buy at the correct times as films and investment influencers popularized over the internet.

You should avoid jumping in and out of the market because of the current market value and rather stay invested in getting strong returns.

The best and worst days in investing are usually close together, and they occur when the market is most volatile, such as during an economic recession or a bear market.

https://unsplash.com/photos/uJhgEXPqSPk

Regularly Review Your Investment Plan

After you set up what you may consider a solid investment plan, it’s advisable to constantly review it and tinker with it to see if it still suits your needs.

You have to understand that your first investment plan will not last forever. You should review it at least once annually or when you reach milestones in your life, such as changing jobs or moving.

Don’t Lose money

Warren Buffet, a legendary investor, said, “Rule number one in investing is never losing money. Rule number two is never forgotten rule number one.” Avoiding losses in your portfolio is something that cannot be stressed enough.

Having more money in your portfolio means you can use it to make money. So, losing money will hurt your earning power in the future.

Saying no to losing money is easier than putting it into practice. According to Warren Buffet, to avoid losing money, don’t become obsessed with the potential gains.

Look at the downsides too. If there aren’t enough upsides for the risks you take, the investment is not worth it. Focus on the downsides first, then consider if it’s worth investing.

Conclusion

Investing in stock is all about doing the right things and avoiding the wrong things in equal measure. Amidst all your investments, it’s essential to keep your temperament in check. You should also motivate yourself to make the right decisions even if they may feel unsafe or risky in the beginning.

Investing safely should be your new mantra. Having long-term investments in stocks that are earning consistently will be generators of great returns. You could also try investing in a group of stocks that may help you make more money because of the diversification and the margin of safety it offers.